st louis county personal property tax receipt

May 16th - 1st Half Real Estate and Personal Property Taxes are due. Search the Real Estate Tax Lookup And Print Receipt application.

Online Payments And Forms St Louis County Website

Monday - Friday 800am - 500pm.

. 41 South Central Clayton MO 63105. Taxes paid in the last three years will have a Print Receipt button on the right hand side. Account Number or Address.

State law requires that personal property taxes be paid before license plates on vehicles can be issued or renewed. Account Number number 700280. May 16th - 1st Half Agricultural Property Taxes are due.

Payments can be made in person at 1200 Market Street Room 109. 1200 Market Street City Hall Room 109. Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm.

Welcome to the Saline County Missouri Payment Website for Real Estate and Personal Property Taxes. Louis real estate tax payment history print a tax receipt andor proceed to payment. Box 245 131 S.

For information call 314-615-8091. Obtaining a property tax receipt. Louis City in which the property is located and taxes paid.

Account Number number 700280. 901 S Vandeventer St. October 17th - 2nd Half Real Estate and Personal Property Taxes are due.

Winchester Street Room 131 Benton Missouri 63736 Phone. For prior years contact the. Monday - Friday 8 AM - 5 PM.

The online payment transaction receipt is not sufficient for license plate. Monday - Friday 8 AM - 500 PM NW Crossings South County. You may file a Small Claims case in the St.

Obtain a Tax Waiver. Monday - Friday 8AM - 430PM. Send your payments to.

E-File Your 2022 Personal Property Assessment. To declare your personal property declare online by April 1st or download the printable forms. After payment you will receive your personal property tax receipt in the mail.

Use your account number and access code located on your assessment form and follow the prompts. The License Offices accept a paid tax receipt which lists individual. November 15th - 2nd Half Manufactured Home Taxes are due.

417-546-7240 for all property assessments or non-assessments. You may also pay your taxes by mail. To declare your personal property declare online by April 1st or download the printable forms.

November 15th - 2nd Half Agricultural Property Taxes are due. August 31st - 1st Half Manufactured Home. How do I pay my personal property tax in St Louis County.

Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. Account Number or Address. Assessments are due March 1.

Collector - Real Estate Tax Department. Scott County Assessor Carla Essner PO. Obtain a Real Estate Tax Receipt Instructions for how to find City of St.

Monday - Friday 800am -. 41 South Central Avenue Clayton MO 63105.

County Assessor St Louis County Website

You Can Pay St Louis County Real Estate And Personal Property Taxes Online Fox 2

Curious Louis Why Do Missourians Have To Pay Personal Property Taxes Stlpr

How To Use The Property Tax Portal Clay County Missouri Tax

St Louis County Missouri St Louis County Website

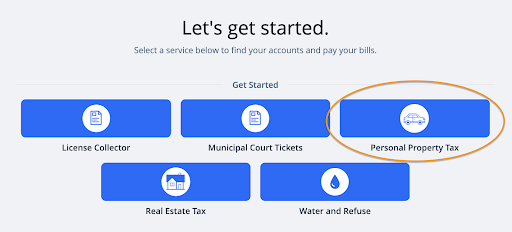

Online Payments And Forms St Louis County Website

Collector Of Revenue St Louis County Website

Collector Of Revenue St Louis County Website

St Louis County Directs Residents To Go Online For Property Tax Receipts

Look For Property Tax Bills In Mail You Can Avoid Lines By Paying Online St Louis Call Newspapers

Collector Of Revenue St Louis County Website

Online Payments And Forms St Louis County Website

Collector Of Revenue St Louis County Website

Find Your St Louis Personal Property Tax Account Number Payitst Louis

Warning About New St Louis City Parking Meters Free Self Help Legal Information For Missouri Residents

Why St Louis County Business Owners Aren T Getting A Tax Break This Year Youtube